Apple faces £3bn legal challenge from Which? over alleged Icloud competition breaches

Consumer rights organisation Which? has lodged a £3bn lawsuit against Apple, accusing the tech giant of breaching UK competition law with its iCloud services. Which? alleges that Apple has been favouring its own iCloud storage services and making it challenging for customers using Apple devices to utilise alternative data storage providers, as reported by City AM. The claim, submitted to the Competition Appeal Tribunal, suggests that customers are effectively locked in as Apple does not permit them to store or back-up all their phone's data with a third-party provider. Consequently, iOS users have to pay for the service once they exceed the free 5GB limit. Which? argues that this lack of competition results in consumers being overcharged annually on their monthly iCloud subscription fees. The lawsuit points out that Apple has increased the price of iCloud for UK consumers by between 20 per cent and 29 per cent across its storage tiers in 2023. Which? is now seeking damages for affected Apple customers who have used iCloud services since 1 October 2015. The group estimates that individual consumers could be owed an average of £70 depending on the duration they have been paying for the services. Anabel Hoult, chief executive of Which?, has claimed that Apple customers are due nearly £3 billion due to the tech giant's imposition of its iCloud services on consumers and stifling competition from rival services. "By bringing this claim, Which? is showing big corporations like Apple that they cannot rip off UK consumers without facing repercussions." she stated. A similar case against Apple regarding this issue is already underway in the US, but it has not yet reached a conclusion. In response to the claim, an Apple spokesperson defended the company's practices: "Apple believes in providing our customers with choices. Our users are not required to use Icloud, and many rely on a wide range of third-party alternatives for data storage."

Why auto dealerships face a perfect storm of risks

Robert Davis

Brokers and agents must protect dealership clients in a new era of exposureMotor & FleetBy Gia SnapeDec 03, 2025ShareWhen CDK Global, a leading dealer management software provider, was hit by a ransomware attack in June 2024, roughly 15,000 customers across North America were forced back to pen-and-paper and improvised workarounds during a critical sales window. Dealerships lost more than $1 billion to the outages, according to industry reports.Over a year later, risks facing US auto dealerships – from cyber extortion and data theft to vandalism and staffing gaps – are converging into a “perfect storm,” according to Rajni Kapur (pictured), CEO of All Solutions Insurance, a California-based agency specializing in auto dealer and garage coverages.Kapur spoke withInsurance Businessabout how the CDK incident has hardened attitudes on cyber risk and what agents and brokers should be doing now to protect dealer clients.CDK attack becomes a cyber wake-up callThe silver lining in the CDK Global attack, which created weeks of operational paralysis for dealerships, is that it led to a sharp rise in cyber awareness.Since that event, dealerships have been taking more precautions around their cybersecurity, implementing encryption for financing documents, and conducting phishing training for staff,” according to Kapur.“I’ve also seen more dealerships opting for cyber liability coverage, which they didn’t always prioritize before,” she noted.Carriers have tightened their underwriting stance for dealerships. Detailed cyber applications, mandatory multi-factor authentication, required employee training schedules, and limited access to sensitive customer information have become standard.In some cases, Kapur said, carriers are conducting direct calls with dealership cyber managers to confirm compliance. “If (dealerships) don’t implement the required measures, the policy may be cancelled,” she added.High-value EVs increase theft severityWhile cyber attacks can compromise vehicle systems, Kapur noted that cyber-related schemes are primarily aimed at customer financial data rather than vehicle theft.Physical theft, however, remains a significant and growing exposure, particularly for electric vehicles and other high-value models.Popular models from brands such as Kia, Hyundai, and Cadillac have been common targets, along with high-demand EVs and catalytic converter thefts. “These claims can be quite hefty,” Kapur noted.Key control is a central point of failure she sees across the industry. On a busy lot, Kapur said, keys can be misplaced, which allows unauthorized test drivers to take vehicles and flee the scene.Brokers and carriers are advising clients to move to locked, access-controlled key cabinets that track employee key usage, restrict access to high-value models, eliminate unauthorized test drives, and position high-value inventory in secure or indoor areas.Motion sensors and increased nighttime security patrols are also recommended.Carriers are increasingly intolerant of repeated theft losses. While a single incident may be acceptable, “if it continues to happen, brokers and carriers don’t like it,” Kapur said. Repeated losses may result in non-renewal or reduced terms.Holiday foot traffic driving theft and collision lossesWhile winter weather traditionally tops the loss tally for many dealerships, Kapur said theft and vandalism now rival natural perils as leading causes of claims. Holiday-season foot traffic presents an especially challenging exposure as bad actors take advantage of crowds to gain access to vehicles.The uptick in customer visits also drives more test drives, more on-lot vehicle movement, and, in turn, more collision activity. Employee-caused damage during vehicle shuffling (already a perennial issue) is rising amid tight staffing and less experienced personnel. At the same time, slip-and-fall exposures also increase with heavier foot traffic.Weather remains a constant seasonal risk, with storms bringing wind damage, flooding, hail, roof leaks, and fallen debris that can affect both open-lot inventory and indoor showroom units.Tips for commercial brokers and agentsAmid tightening markets and heightened exposures, dealerships must prioritize thorough coverage reviews and strong risk management. For agents and brokers, rigorous cyber and key control practices are now essential in protecting auto dealer clients.Kapur urged fellow agents to revisit auto dealer portfolios and verify that foundational coverages reflect current exposures.Dealer’s open lot coverage remains “one of the most important” protections, she said, addressing losses stemming from weather, theft, vandalism, and on-lot collisions. Ensuring vehicles are insured to value, particularly the highest-valued units, is also critical.Garage liability and garage keepers liability are also essential. Kapur noted frequent oversights in garage keepers coverage, especially the need for “direct primary” protection to ensure customer vehicles in the dealership’s care are covered for weather or collision events.For larger lots with higher inventory levels, Kapur recommended umbrella limits between $2 million and $5 million, and up to $10 million for the largest operations.“When we review existing policies, we often find missing pieces,” Kapur said. “We then recommend that the dealership add whatever is missing so their coverage is as complete as possible.”Related StoriesAuto dealerships facing rising transit losses amid theft 'epidemic'Supply chain attacks are on the rise – how can brokers help?

Vianet celebrates contract with major blue chip brewer in the UK

Drinks and vending tech provider Vianet has landed a significant contract win with major brewer in the UK. The Stockton-based firm says the agreement with the unnamed, blue chip customer will see it supply its Beverage Metrics draught beer monitoring technology across the country. It will provide performance insights into the customers draught brands. Vianet will begin installations of the tech in this financial quarter and continue phased delivery throughout the rest of the year. The move is expected to grow the group's UK installation footprint by about 5% in the next 18 months, and support Vianet's expansion further into the hospitality sector beyond the leased and tenanted market. The contract follows Vianet's acquisition of US-based Beverage Metrics in 2023. The addition of the Denver company, in a deal worth up to £4.5m, has helped Vianet bolster its "one stop drinks management solution" that can reduce costs, improve productivity and maximise sales. Announcing the contract to investors on the London Stock Exchange, Vianet bosses said it was a strong validation of its tech and strengthened its relationship with The Oxford Partnership - a market intelligence consultancy working with major brewers, who helped Vianet secure the work. The firm said it would help it attract interest from other potential clients. James Dickson, chair and CEO of Vianet, said: "This new agreement represents a strong strategic validation of our investment in Beverage Metrics and the value of our partnership approach. These collaborations are unlocking exciting commercial opportunities within the hospitality sector and beyond, combining our technological capabilities and the Oxford Partnership's analytics and AI expertise. "The phased rollout of our Beverage Metrics solution with a leading global brewer further highlights the innovation and impact of our technology, as it empowers customers to optimize performance and navigate challenging trading conditions effectively. Combined with the encouraging progress we are making in the USA and the recent long-term contract extensions with Heineken's Star Pubs & Bars and Greene King, this milestone underscores the growing recognition of our solutions and their ability to deliver tangible value by helping customers achieve more with less."

Transport for Wales launches new high speed internet network

Transport for Wales has launched a new full fibre high speed internet network which was installed in tandem with the South Wales Metro rail electrification project. In a UK rail industry first the transport body of the Welsh Government said its wholesale network can be reached by one million people, through new subsidiary venture TfW Ffeibr. Alexia Course, chief commercial officer at TfW said: “We’re extremely proud and excited to be launching TfW Ffeibr, to provide a state-of-the-art high-speed network for companies to use and sell within Valley communities. “We’ve been carrying out huge infrastructure works in the Valleys, electrifying the railway line as part of the South Wales Metro and this presented us with an opportunity to also build the infrastructure for a high-speed core network. “The Metro project is about physically connecting people and TfW Ffeibr is about connecting people in the digital world. At TfW, we’re fully aligned to the Well-being of Future Generations (Wales) Act and this new subsidiary business reinforces our commitment to improving the lives of people in Wales.” Guy Reiffer, managing director at TfW Ffeibr, said:“This is an industry and UK first – a rail infrastructure project that has diversified and utilised its construction to also install a high-speed, full fibre internet capable network. “We’re excited to launch and we’re looking forward to working with teleco companies to provide big-bandwidth full fibre internet for communities that are harder to reach. “For people living in the Valleys, high-speed internet enabled by our core fibre offering will open up lifestyle and business opportunities.” As well as reaching around one million people, TfW Ffeibr is currently accessing the number of business that could utilise the network., which is though accessible to many of the region's business parks. TfW Ffeibr is currently talking to a range of internet service providers and telecommunication (telco) companies over commercial use of its wholesale network. It said: “This will be either to connect towns and villages where an internet service provider is building out those towns or to connect businesses for those internet service providers or telcos, We cannot comment on individual discussions at this stage.” For those using the network TfW Ffeibr will charge a connection fee and for the distance provided. It declined to comment on projected revenues in its first three years. TfW wouldn't disclose the cost of installing the fibre on the Metro network. The bill for electrifying the Core Valley Lines, along with part of the City Line and the Coryton Line in Cardiff, will come in at just over £1bn. Moreover, alternative full fibre teleco, Ogi, has installed a new full fibre leased line connection at Cariff City FC’s training centre at Hensol in the Vale of Glamorgan. The new infrastructure is already boosting the club’s ability to process performance data in real time during training sessions. Ogi is already a well-known name in sport, with Cardiff Rugby, Parc y Scarlets, and the home of Welsh rugby, the Principality Stadium, among its customers. It also has sponsorship deals with Haverfordwest County AFC and the community-owned Merthyr Town FC. Ogi’s chief executive, Ben Allwright, said: “As a big football fan, I’m delighted to see Ogi supporting our home city club, Cardiff City. There’s a real sense of community among City’s supporters – and this plays to our community-centric ethos here at Ogi too. “Bringing our connectivity to the Bluebirds’ training base has the potential to help the teams develop their game and I’m very excited to see how increased access to real time analytics plays out on the pitch.” Huw Warren, head of commercial at Cardiff City FC, said: “Ogi is a strong signing and welcome addition to the Cardiff City family. They’re a Welsh brand making huge strides across the country right now and the support they’ve given since our partnership started has been exceptional. “Ogi’s full fibre technology enables us to do things faster and more efficiently, accessing data in the split seconds that matter on the pitch.

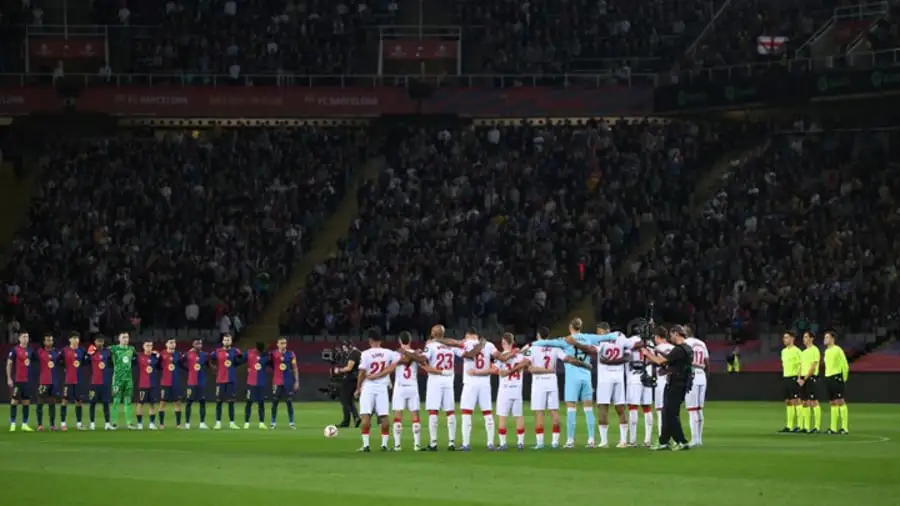

LaLiga clubs pledge to help raise money for victims of Spain's flash floods

'Cyber security is no longer just an IT issue': QBE urges cross-functional cyber prep

Emily Smith

Discover the Impact of Medical-Grade Skincare on Achieving Optimal Skin Health

Robert Brown

Kinewell Energy targets Asia-Pacific growth with revamped software products

'A multibillion-dollar platform in motion': United Risk hits top-five MGA status

Emily Brown

Unveil the Ideal Body Wash for Your Skin's Unique Needs

Aurora Cruz

I had two choices – either pick up the phone or die, admits Jeff Whitley

JEFF WHITLEYhas bravely opened up about his battle with addiction and recovery from the depths of despair.The 45-year-old starred for Manchester City and Sunderland and earned 20 caps for Northern Ireland between 1997-2005. JEFF WHITLEYhas bravely opened up about his battle with addiction and recovery from the depths of despair. The 45-year-old starred for Manchester City and Sunderland and earned 20 caps for Northern Ireland between 1997-2005. But behind the scenes, battles with alcohol and drugs led to problems off the pitch, including bankruptcy and a spell in rehab. Now in a position to help others, Whitley, who is the PFA’S player welfare executive, wants to raise awareness of the dangers behind addiction. He told the BBC: "Nearly every club had moved me on because of the off the pitch antics. Not being able to keep it together or say no to some of the times I went out. "I didn’t know how to keep it under control or even understand what the problem was. "Eventually the drink and the drugs really started to escalate. "I had two choices. I either keep doing what I’m doing and maybe die, or I pick up the phone and ask for help." After getting to the point of where he was "sick of feeling this way", Whitley knew he had to make a change. He phoned the Professional Footballers' Association for help and, in a time frame that left him "amazed", he was assessed by Sporting Chance before going through treatment and rehab for 26 days. He exclusively revealed to The Sun in 2019: "I caught a glimpse of myself in the mirror and thought, ‘I don’t know who that guy is.’ I’d completely lost myself. "When you’re young and you’ve got a few quid in your pocket, it can be quite exciting and highly addictive. "But you go from being super confident and chatty to wanting to be on your own in complete isolation." Whitley has been sober since entering rehab, but still continues to attend AA meetings and therapy. And after years of drug taking drove one of his brothers, Jack, to suicide in 2017, Whitley knows just how brutal substance abuse can be. In 2019, he backed The Sun’s End of The Line campaign to help raise awareness of the devastating dangers of cocaine and its impact on mental health. He explained: "You’re almost chasing that high from when you first took it, thinking that next line is going to be like the first one you took. "The insane paranoia is mind-blowing. Call it curtan-twitching- any siren, any noise, you think they're after you. It's a proper frightening place to be. " Whitley was shipped out on loan to Wrexham and Notts County during the final three years of his City contract, before joining Sunderland in 2003. He explained that the Black Cats, and later Cardiff, then "moved him on" for his off-field antics. His growing addictions ultimately led to his international career coming to a premature end after scoring two goals. Northern Ireland's 1-0 win over England at Windsor Park in 2005 is one of the most famous nights in the country's history. However, Whitley had to watch it from home after being sent away from the camp by manager Lawrie Sanchez for going out with team-mate Philip Mulryne. Whitley was still playing at a high level for Cardiff, but the damage was done. He would never play for Northern Ireland again. After being left jobless at the end his football career, he briefly worked in car sales before turning his attentions to using his experiences to help others. Whitley added that he understands that some players may not want to pick up the phone or ask for help. "I know how difficult it was for me to reach out. I was sick of being on this hamster wheel of living that way. You’re not living, you’re just existing. "When you are abusing your body with alcohol and drugs, and stuff like that, then you are going to go one of two ways. "Some of the people are not at that point. Just don’t hesitate to reach out, that’s what I would say."

Teesside tech firm to expand with multimillion-pound investment

Teesside tech specialist Salesfire is set to enhance its platform with AI technology and create new jobs, following a £2.75m investment. The Middlesbrough-based firm, established in 2017, aids clients such as Hamleys, Moss Bros, Select fashion, Sportsshoes.com and Trespass in boosting sales via their ecommerce sites, with its software now used by over 700 brands. The company has secured an additional £2.75m from NPIF II – Mercia Equity Finance, managed by Mercia Ventures as part of the Northern Powerhouse Investment Fund II. The funding will be used to integrate the latest AI-powered technology into its platform and generate more than 10 new jobs within the next two years. Salesfire's software creates a profile for each visitor to a company's website, using behavioural cues to comprehend their interests and shopping habits. This allows retailers to personalise the customer experience, guide shoppers through the purchasing process, and re-engage with them to foster relationships. The firm is developing new AI technology that will provide deeper insights into customer behaviour, such as identifying anonymous individuals with different user accounts. Founder Rich Himsworth believes this will be particularly beneficial once existing tracking tools like cookies are phased out. Mr Himsworth, who previously worked in software and marketing, founded Salesfire seven years ago and has since grown the company to employ 65 staff, generating £3m in annual recurring revenue. Following initial backing from Mercia and NPIF in 2022, the latest funding round brings the total investment to over £5m. Mr Himsworth stated: "Salesfire's mission is to help retailers grow their e-commerce sites and drive revenue. Our new Salesfire AI technology will be revolutionary in giving them scope to identify more anonymous site traffic and opening up a whole new world of marketing and data opportunities. We are pleased to have the continued support of our investors in this latest round and really excited to be at the forefront of AI in e-commerce." Chris McCourt of Mercia Ventures said: "Salesfire stands out from competitors by offering the type of sophisticated features normally only available in more costly products. Its new AI technology will make the platform even more powerful and initial trials have shown it can further increase sales. This Investment will enable the business to accelerate its development and further differentiate itself in the market." The funding comes from NPIF II – Mercia Equity Finance, which provides equity investments in the Yorkshire and Humber regions. The Northern Powerhouse Investment Fund II (NPIF II), valued at £660m, spans the entire North and offers loans ranging from £25,000 to £2m, as well as equity investments up to £5m.

Inter Milan captain Lautaro "honoured" by Messi's Ballon d'Or support

The Inter Miami captain insisted Lautaro should've won this week's Ballon d'Or award."It’s an honour that the greatest player ever thinks this about me,” Lautaro told Icon Magazine.“I am happy to be among the candidates, as it recognizes a great season with my national team and club. The Inter Miami captain insisted Lautaro should've won this week's Ballon d'Or award. "It’s an honour that the greatest player ever thinks this about me,” Lautaro told Icon Magazine. “I am happy to be among the candidates, as it recognizes a great season with my national team and club. “I’ve developed as a man and as a footballer. “When I arrived in Italy, I was a 20-year-old kid, and I’ve become a father and husband in these last six years. This has helped me improve as a player, and I proudly became the Inter captain.”

'Flying taxi' firm to use AI in bid to speed up aircraft testing

A Bristol company that is developing an all-electric 'flying taxi' has struck a deal that will see it use artificial intelligence to speed up the testing of its aircraft. Vertical Aerospace, which was established by Ovo Energy founder Stephen Fitzpatrick in 2015, will work with AI software provider Monolith to improve the performance of its VX4 vertical take-off and landing (eVTOL) aircraft and accelerate its time to market. The South West-based firm will use AI for new design insights and more efficient test plans in less time, it said. The first project will focus on testing and simulation of the VX4’s supporting pylon structures for ground tests of the propeller and electric motor structural and performance requirements. "Flight and ground tests for eVTOL are incredibly complex, expensive, and time-consuming, typically requiring engineers to spend hundreds of hours validating simulations across tens of thousands of parameters and operating conditions," a spokesperson for Vertical Aerospace explained. London-based Monolith has a proven track record in aerospace engineering following recent projects with Airbus and BAE Systems on aircraft and drones. Dr. Richard Ahlfeld, chief executive and founder of Monolith, said: “Urban air mobility has the potential to revolutionise how we travel, and one of the most promising contributors to this transformation is Vertical’sVX4. "With Monolith, Vertical will model complex systems faster and accelerate test campaigns, enabling the company to learn more about design performance while reducing development and testing time.” David King, chief engineer of Vertical Aerospace, added: "Transforming how the world moves requires constant innovation. Collaborating with Monolith allows us to harness cutting-edge AI technology to streamline our testing processes, enabling us to focus on the most impactful areas and accelerate the VX4’s journey to market."

Sir Jim Ratcliffe and Co must bring clarity and finally seal the deal for Amorim

AI isn't just cutting costs - it's rewriting the insurance playbook

Sarah Brown

Newcastle property firm iamproperty to create 100 jobs over coming months

23andMe, supported by Richard Branson, announces major layoffs and strategy shift following data breach

State Farm cuts auto rates in Georgia

Michael Brown

IT services firm strikes Birmingham City deal

Discover the Multifaceted Benefits of Shea Butter for Your Complexion

David Davis

Diving Into the Reality of Gynecomastia Recurrence Post-Surgery

Emily Brown

London holds on to crown as tech capital of the world as New York closes in

London-based Truelayer cuts a quarter of staff, loses unicorn status in new funding round

APCIA supports bill to limit foreign influence in US litigation

David Williams

AI startups have captured a quarter of UK VC funding in 2024

Latest Articles

Achieving Natural Radiance: The Path to Healthy Skin

Emily Johnson

Universal child care rollout reshapes risk and insurance considerations for providers

John Smith

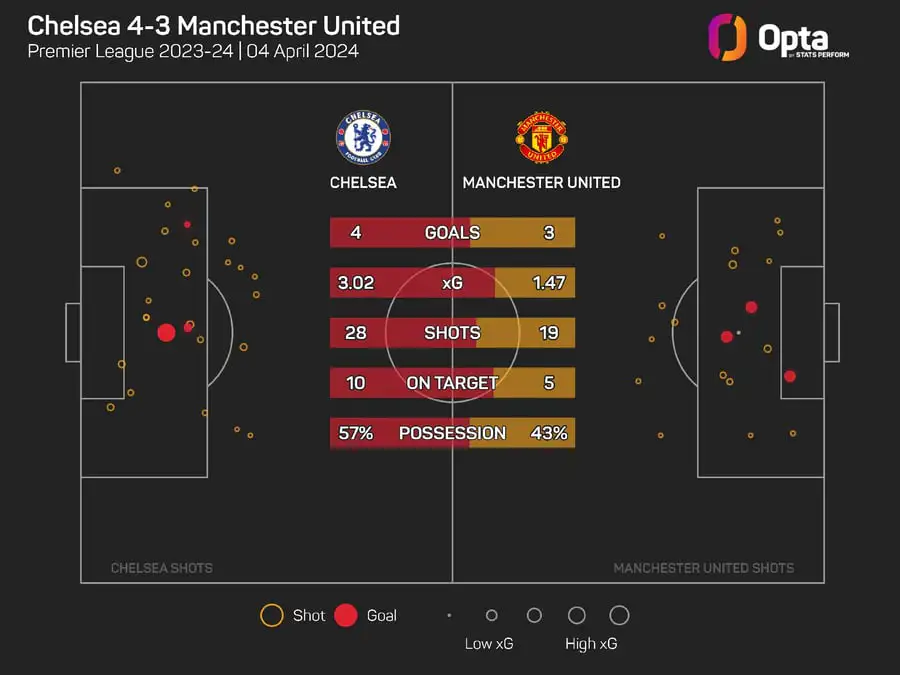

The Numbers Game: Can Van Nistelrooy get Man Utd back on track?

The Crucial Impact of Sleep on Skin Wellness: Maximizing Your Beauty Routine with Quality Rest

Samuel Ross

Tyneside tech firm Leighton moves to new city centre offices

Lazio president insists he will not sell former Arsenal flop 'even for £59M'

Industry groups back California Commissioner's insurance reform

Robert Miller

Eighth Circuit backs Liberty Mutual's denial of absentee homeowner's fire claim

Emily Davis

I’ve played with special talents like Cole Palmer and Phil Foden…

Allianz Commercial establishes Miami hub to deepen LatAm footprint

Jennifer Davis